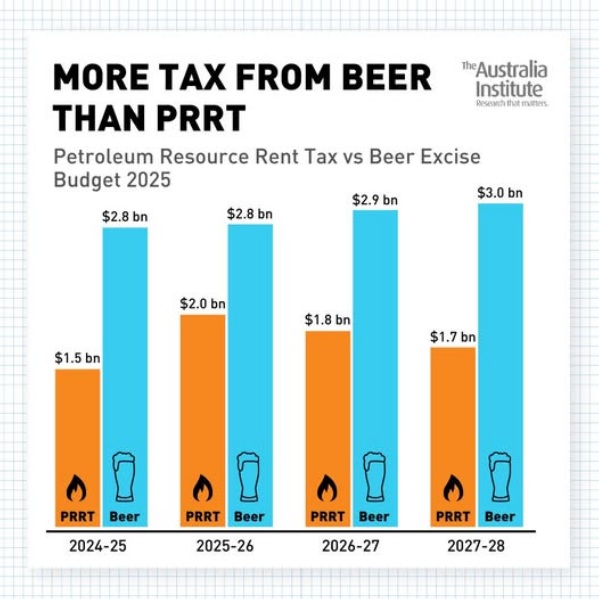

In recent weeks the Australia Institute has been ramping up its claims that Australia’s major oil and gas producers don’t pay enough tax. For example, on Instagram it posted a chart showing that the Australian government raises more revenue from beer than the Petroleum Resource Rent Tax (PRRT):

The above chart is a good example of what’s called a false equivalence: comparing apples and oranges. Assuming the data are correct, so what if the Australian government collected more revenue from its beer excise tax than the PRRT? They are completely different taxes, with different purposes, targeting different sectors. The fact that more money is raised from beer excise—a consumption tax—tells us nothing about the PRRT, which only applies to offshore projects that generate economic rents after recovering substantial capital investments.

They’re quite fundamentally incomparable.

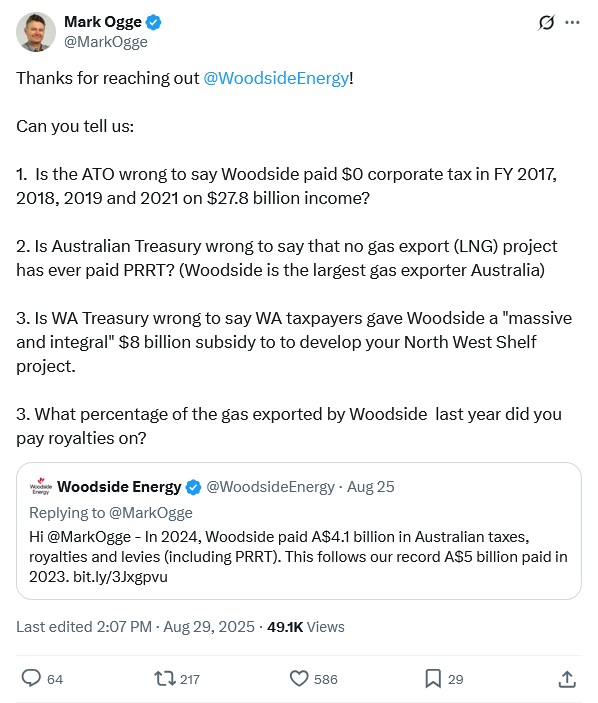

In a more direct critique, Mark Ogge—who I believe works for the Australia Institute—posed the following questions for Woodside, a major oil and gas player in Australia:

Ogge thinks these are a ‘gotcha’, but they’re actually easily answered with just a few minutes of research.

- Is the ATO wrong to say Woodside paid $0 corporate tax in FY 2017, 2018, 2019 and 2021 on $27.8 billion income?

There are two major issues with this statement that even a first year accounting student should know. The first is that Australia doesn’t tax companies on total (gross) income but taxable income, i.e. income after the expenses made as part of generating the revenue. Ogge’s income figure is essentially meaningless when discussing tax—Woodside may have incurred costs far greater than income in some of those years, and we certainly don’t tax losses.

The second is that’s not what the ATO said. Woodside paid $454 million in corporate tax in FY20, A$390 million in FY21, A$1.4 billion in FY22, and A$3.1 billion in FY23 (odd that Ogge didn’t ask about more recent years). The reason Ogge is hinting that it paid no tax is probably because the ATO’s data are published by entity rather than whole groups, so he’s almost certainly excluding Woodside’s joint ventures (e.g. Burrup) from his analysis of earlier years.

Deliberate misinformation, or a simple error? I’ll leave it to you to decide.

- Is Australian Treasury wrong to say that no gas export (LNG) project has ever paid PRRT? (Woodside is the largest gas exporter Australia)

I’m not sure what source he’s using here but between FY2001 and FY2018, Woodside paid approximately A$2 billion in PRRT. The statement from Treasurer Chalmers in 2023 announcing his government’s PRRT reforms only said that “most LNG projects are not expected to pay any significant amounts of PRRT until the 2030s”. Notice how he said “most”, not “all”? That means at least one LNG project has already paid PRRT, debunking Ogge’s claim.

The reason why producers aren’t expected to pay much PRRT until the 2030s (sooner now after the reforms) is that the tax was designed to only be payable after investment costs are recovered.

- Is WA Treasury wrong to say WA taxpayers gave Woodside a “massive and integral” $8 billion subsidy to develop your North West Shelf project.

Yes, because that’s not what the WA Treasury said. It’s true that the WA government paid an estimated $8 billion to support the North West Shelf project (in 2010 net present value terms). However, most of that was spent to ensure it would unlock domestic supply—hence the 20-year take or pay contracts and construction of the Dampier to Bunbury gas pipeline—and to fulfill its public service obligations towards “town site development, schools, hospitals, community facilities and roads”.

I’m not suggesting the government should have subsidised the project to such an extent, but domestic supply security has been a long-running policy objective of the WA government.

- What percentage of the gas exported by Woodside last year did you pay royalties on?

Australian states collect royalties from all onshore gas production revenue, not profits, so Woodside would have paid royalties on 100% of its domestic gas sales. Constitutionally, the federal government cannot levy royalties (other than for legacy projects like the NWS), so it relies on the PRRT and corporate tax for offshore projects (with a royalty sharing agreement for the NWS because of how old it is).

Anyway, to answer the title of this post: do Australia’s oil and gas companies pay enough tax? Probably not: the PRRT, even after the changes to allowable deductions made by the Albanese government in 2023, is probably still a flawed tax that is too generous to producers in terms of uplift rates for carried-forward losses. The economic rents generated by projects that extract finite resources above and beyond what was needed to ensure they were still an attractive investment (e.g. when a war causes oil and gas prices to surge) should be taxed relatively heavily.

But because of how the PRRT is designed, Australia’s LNG exporters are going to start paying more of it in the coming years—Woodside paid $936 million in FY2023—and you certainly wouldn’t want to materially change the rules in the middle of the game. As the Commonwealth Treasury warned nearly a decade ago:

“Any significant increase in the tax on existing petroleum projects may substantially increase perceptions of the fiscal risk associated with investments in Australia and may deter future investment. Moreover, concerns over fiscal risk are likely to be exacerbated if changes impacting on existing projects are perceived to be ad-hoc and arbitrary. "

Australia’s tax and transfer system should absolutely be exposed to legitimate debate, but it should be done using accurate comparisons and the full context, rather than statistical sleight of hand that could manipulate the masses towards what is essentially a degrowth agenda.