In early November 2020, the Reserve Bank of Australia embarked on what’s known as quantitative easing (or ‘QE’ for short), which is the fancy term for when central banks buy government bonds to increase the money supply or lower long-term interest rates. It’s especially popular when the cash rate is at the so-called ‘zero lower bound’, i.e. at or near zero, but the central bank still wants to ease monetary conditions. As former RBA Governor Philip Lowe said at the time:

“The lower interest rates and our plan to buy $100 billion of government bonds over the next six months will help people get jobs and support the recovery of the Australian economy.”

Earlier this year, a Freedom of Information (FOI) request seeking documents between 1 July and 3 November 2020 about the costs, benefits, or risks of the RBA buying government bonds was released by the bank. In other words, it was looking for the evidence that Lowe had on-hand when he and the RBA’s board made their decision.

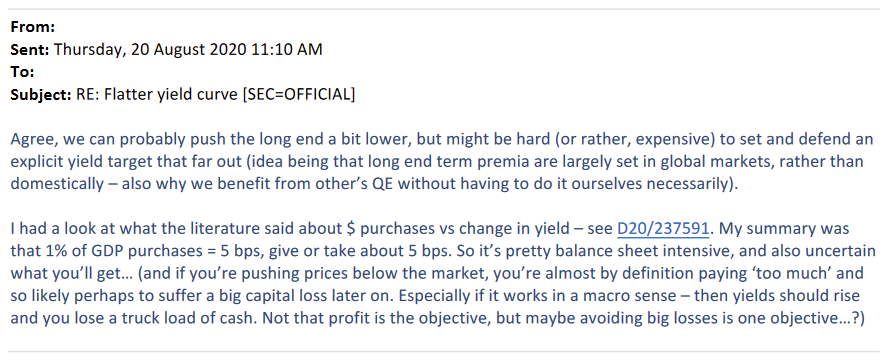

The trail of emails began in August 2020 after several other countries, including England, the US, EU, Canada, and New Zealand, had already been running their own bond buying programs for a few months. In the first email, Governor Lowe asked an analyst what they thought about “a flatter AUD curve”, and “our ability to achieve it”.

After some internal back and forth that saw one analyst warn about the potential to lose a “truck load of cash”, the final email to Lowe stated that they were “sceptical about how helpful it would be… and there is a lot uncertainty about the potential outcomes”.

The following are all direct quotes from the final email sent to Lowe, with the points trimmed for the sake of brevity:

We could flatten the curve at a relatively low cost

- Bond purchases would increase the size of our balance sheet substantially, exposing us to losses (if we are successful in stimulating demand and inflation).

- Market functioning might be impaired if we end up holding a large share of government debt.

- Bank profitability could be diminished a little.

But the benefits also seem low, particularly while tight COVID restrictions remain in place

- Some depreciation of the exchange rate.

- Some portfolio rebalancing.

- Little to no impact on government financing.

- Little to no impact on borrowing rates.

Despite those warnings, the RBA’s board decided to proceed.

The formal analysis was toned down#

The FOI included three short internal reports, dated 21 September, 1 October and 12 October 2020. The reports may have made it all the way to the top brass of the RBA, but we can’t know for sure given that the names and email addresses were redacted.

What the reports do not discuss are the costs, benefits or risks of QE in Australia. The only way that’s possible – the RBA’s analysts are switched on and would have investigated those issues, unless instructed otherwise – is if the RBA’s board had already decided it wanted to do QE and only wanted to know how much and for how long.

Curiously, a section in one of the reports that examined the response to QE in other countries found “the change in yield seen is not closely related to the size of the [balance sheet] expansion”, i.e. the economic impact was uncertain at best. Yet the RBA’s board cast that inconvenient fact aside and proceeded with its own version of QE anyway, providing this explanation at the time:

“This quantity target is similar to the approach adopted by many other central banks, which have responded to the pandemic with government bond buying programs. The evidence is that these programs have lowered government bond yields in other countries.”

That’s certainly an ‘interesting’ (i.e. incorrect) interpretation of the evidence that it was provided by its analysts! Perhaps the RBA’s board just didn’t want to miss out on all the fun other central bankers were having with their new tool.

Based on the evidence above, the RBA’s board looks as though it was flying relatively blind. It had some idea of what a $100 billion QE might do to the exchange rate, asset prices, bank profits, and yields. It knew there might be “modest” benefits. But it did not even come close to undertaking a cost benefit analysis before engaging in one of the most extreme and costly examples of discretionary monetary policy Australia has seen in the post-float era.

Across the three reports, the only warning about possible costs was provided as a single paragraph:

“A QE program would be expected to push term premia lower still, and might result in a capital loss for the Bank if the yields that bonds are purchased at do turn out to be lower than average future short-term rates.”

“Might result” – understatement of the decade!

It was a very costly blunder#

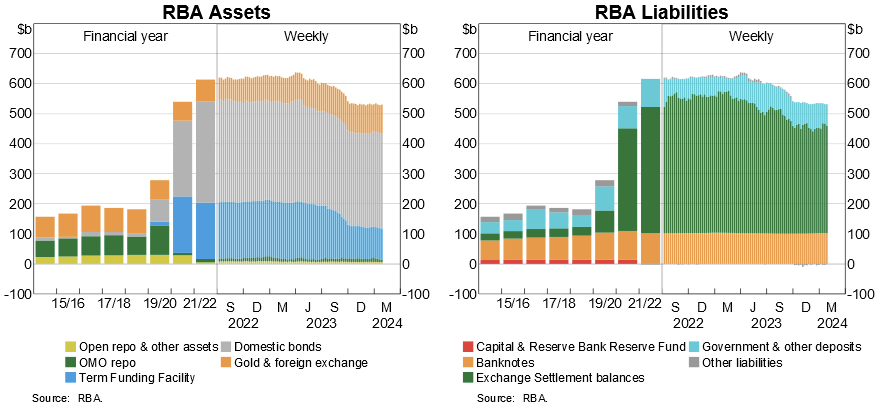

Despite its fancy name, QE is just the process of restructuring the maturity of government debt held by the private sector. The RBA buys long-duration federal and state government bonds on the market in return for short-duration “exchange settlement (ES) balances”, which are equivalent to cash held on deposit with the RBA. It then pays interest on those ES balances to prevent rates from falling too far below its cash rate target (see here for an explainer).

The RBA’s own charts show this effect in action, with the surge in bond purchases on the asset side matched very closely by growing ES balances on the liability side on its balance sheet:

Given that Australia’s federal and state governments were adding debt at a much faster rate than the RBA was buying bonds, and that Australia is very exposed to global financial markets, it’s unlikely the RBA’s QE had much of an impact on duration or yields.

But what it did do was send a signal; a signal that the RBA was serious about keeping rates down for a long time, encouraging people to take on more debt than they otherwise might have. If we were going through a financial crisis, that may have been OK, but the pandemic was mostly a negative supply shock. To ease a supply shock, you need supply-side reform and fiscal restraint, not demand-side stimulus such as QE.

As a result, Australia’s QE resulted in large and largely undocumented costs.

First, it raised asset prices and inflation (which the RBA considered to be a benefit at the time) and burdened those who believed the signal and over-levered themselves ahead of what would be a sharp monetary tightening cycle.

Second, bond yields move inversely to prices. As discussed earlier, QE just swapped some of the private sector’s lending to the government from bonds to ES balances at the RBA. When inflation showed up and the RBA eventually started tightening monetary policy, the low-yielding bonds it bought at record-high prices were worth much less. To credibly tighten monetary policy, the RBA also had to start paying higher rates of interest on ES balances than it receives from those bonds.

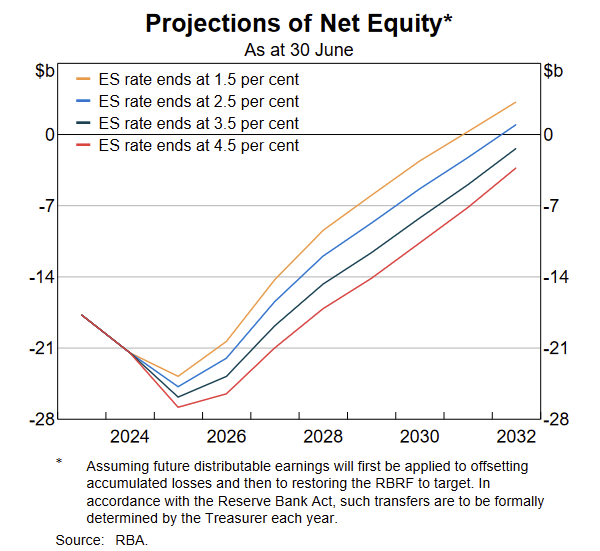

That second effect has led to large losses: as at 30 June 2023, the RBA had lost a cumulative $17.7 billion due to the unrealised valuation losses on its holding of bonds and from the interest it pays on ES balances.

While many of the RBA’s losses are unrealised and will fall over time as its bonds approach maturity and tend towards face value (the RBA paid above face value, so will realise losses of at least $19 billion), it’s still very real from a taxpayer’s perspective.

For example, because of its QE losses the RBA will not be able to pay what is normally a multi-billion dollar dividend to the government for perhaps a decade or more, which is how long the bank expects it to take for its balance sheet to return to positive net equity:

If inflation proves to be persistent and the RBA holds rates at present levels, or raises them even further, then the losses it realises on ES balances will continue to grow until the final bond rolls off the RBA’s balance sheet in 2033.

The RBA’s own estimates suggest it could lose between $35 to $58 billion on ES balances by 2033. Add that to the guaranteed $19 billion loss on its bonds and the total fiscal cost to Australia of the QE experiment will be above $50 billion, or 2% of GDP.

Using the RBA’s lower estimate, that’s equivalent to more than $5,500 for every Australian household stemming from a decision made by unelected officials who had several months to think about it (other countries started doing their own versions in March 2020) yet did not bother asking for so much as a cost benefit analysis.

Central banking at its finest!